Outcome Metrics: Measuring What Matters in the Nonprofit World

Amid increasing demand for transparency and accountability, today’s nonprofits are seeking ways to both produce and to demonstrate successful outcomes. Heightened expectations and heightened scrutiny come from several sources—including ever more-engaged funders looking for financial management techniques and principles employed by for-profit businesses.

To meet this demand, nonprofit organizations are embracing outcome metrics to measure and report their performance. Outcome metrics not only show funders and constituents how the organization is performing; they also help pave the way for sustainable growth and greater efficiency.

Nonprofits can effectively leverage outcome metrics to boost their success and here's how...

What are Outcome Metrics?

Outcome metrics are powerful, essential tools for demonstrating accountability and transparency.They can measure financial or non-financial criteria that reflect an organization’s, program’s, or initiative’s efficacy. They’re derived by carefully defining outcome indicators, data-collection methods, analytical techniques, and presentation vehicles that collectively show a rich picture of organizational performance.

These outcome metrics may go by many names and fit in countless categories. Many nonprofits obtain their best results by measuring across multiple dimensions for blended scorecards that encompass activities, capacities, financial results, and other metrics. Ultimately, well-defined outcome measures help organizations to continuously adapt and improve.

Why Outcome Metrics Matter

The importance of outcome measures can be seen from a variety of perspectives and functions within the nonprofit organization. These include:

• Funding—In a competitive environment, the ability to define, measure, monitor, and report the metrics that define success can encourage new and additional funding from donors, foundations, and other benefactors. For instance, demonstrating achievement of key milestones can unlock subsequent rounds of multi-year grants.

• Accountability—Funders are increasingly tying their support to stringent accountability. They want to see where their monies are going and the results that are achieved–whether it’s organizational growth and new locations or more nonprofit partnerships and matching funds. Nonprofits must provide exceptional transparency into the organization’s outcome metrics, controls, and reporting.

• Stewardship—From development and accounting to operations and programming, the ability to define, track, and report outcome measures–showing where you are and where you want to go—will help ensure good stewardship. This, in turn, will boost donor confidence and strengthen your credibility—which supports your growth and your ability to pursue your mission.

Who’s Monitoring Nonprofit Performance?

With intense competition for donor dollars—and funders insisting on greater accountability and visibility—nonprofits must show fiscal responsibility as well as program results.

The call for greater transparency and accountability is growing louder. Just as financial analysts and credit rating agencies scrutinize a corporation’s financial performance to make recommendations, charity evaluators are diving deeper into nonprofit results—and they’re expanding their evaluations and criteria to include the tracking and reporting of non-financial performance and outcome metrics.

Charity Navigator, the premier charity evaluator, has for years used very specific financial metrics when computing its nonprofit ratings, which have a significant impact on nonprofit funding. Now the organization has declared that financial metrics are not enough. By 2016, it will begin tracking outcome metrics–and the reporting of those measures.

Your efforts to track outcome metrics for your organization will encourage accountability among other organizations while building your credibility and reputation. You can expect your community to become more engaged and supportive–resulting in a virtuous cycle of greater visibility, strengthened credibility, and a more committed support network.

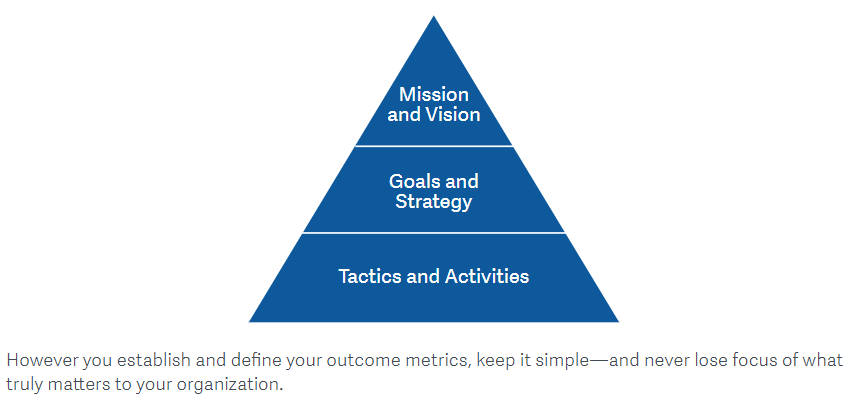

Linking Metrics to the Mission

Outcome metrics deliver value only if they are tightly linked to your core values and mission(otherwise, they are only a resource-draining distraction). So it’s best to start with a simple template that defines what matters—your organization’s short- and long-term objectives—and the impact measures that effectively map to them. Set goals and strategies that help ensure your activity measures support the overarching mission. These might include progress toward goals, and program implementation; e.g., projects launched and sites protected. Finally, drill down to define the supporting tactics and activities. These might be measures of memberships, funding, or growth in fundraising.

The Best Path to Success: A Balanced Approach

The key is to balance financial- and performance-based outcome measures. Outcome metrics includeall measures that reflect organizational performance and impact. These can include performance(e.g., program efficiency), outcomes (e.g., meals served), capacity (e.g., membership growth), financial (e.g., budget to actual), or sustainability (e.g., operating reliance). If you report solely financial-based metrics, your potential funders won’t know whether you are successful in your mission and in meeting your stated goals. Consider: Your programs and activities can grow and be hugely successful, but without organizational capacity and sustainability, the programs—and their impact—will come to an end.Define key indicators across the spectrum to ensure that you are getting—and giving—a complete picture to key stakeholders, staff, and constituents. Your website is a great way to communicate that focus, and to ensure that both internal and external constituents have access to the information.

Set Up Your Plan

It can be challenging to start. With your mission and a balanced approach firmly in mind—and with your leadership engaged—define the top three indicators that best reflect your progress and impact, and how you will measure and monitor them.

Next, identify supporting metrics that help ensure peak performance. Ensure each metric aligns with your strategic mission. Make those measures integral to your annual strategic plan. When you focus on what and how to measure, you inform other aspects of your strategic planning, strengthen your stewardship and performance, and increase your mission impact.

Some of the metrics that many organizations have found helpful include:

• Program efficiency—This metric may be the most important for many charity evaluators, board members, and donors because it shows how funds are used: For overhead, or for making progress. The basic formula...

Program efficiency = Total program services expenses ÷ total expenses

...clearly indicates program and mission priority.

• Revenue per member—Many membership-based organizations rely heavily on membership dues and program fees. How much revenue are you generating from your membership?

Revenue per member = Member revenue ÷ member count

This metric tracks not only the changes in membership, but also the revenue trend per member.

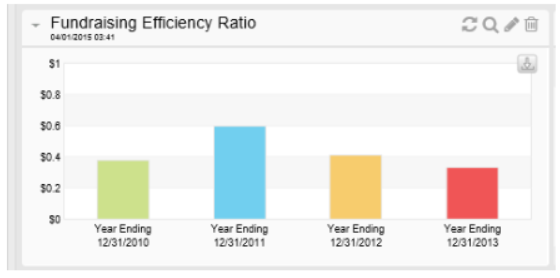

• Fundraising efficiency—How much do you spend to raise a dollar? This metric shows how efficiently your organization raises funds.

Fundraising efficiency = Unrestricted fundraising expenses ÷ total unrestricted contributions raised

Modern fund-accounting software can easily track and tag your expenses and revenue to automatically calculate and report on this key metric. For example, if your annual gala raises $1,500,000, and costs $350,000, your fundraising efficiency is $0.23. It cost you $.23 to raise $1.

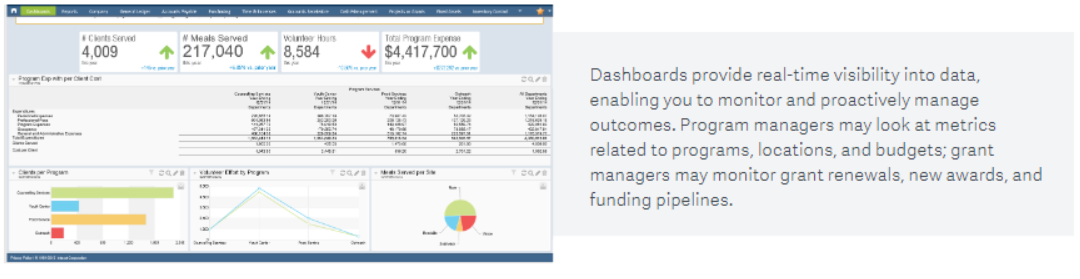

The Right Financial Software System Matters

Making A Difference

Take the first step: Define the key metrics that best measure what is most important to your mission. Don’t get bogged down with tactical issues such as “Who will measure what—and when?” The subsequent details and processes follow naturally–especially when you use a modern financial system to make it easy.

Take advantage of external resources to get up to speed quickly. You may have too few or too many metrics, but consistent progress brings success. Balance your approach with measures that reflect the complete picture of your organization’s health and impact. Measuring and reporting outcomes will require extra effort. But doing so brings immediate and long-term benefits to the organization as well as its funders and constituents.

If you'd like to learn more about Sage Intacct and what it can do for you, register for the

Sage Intacct Coffee Break Demo

below and see what's possible!

Take a Coffee Break with Sage Intacct

Find out why Sage Intacct is the best choice for your business.

Gina of DeRosa Mangold Consulting explains why you should at least take 45 minutes to watch the Intacct Demo to discover what it can do for your business.

People are talking...

Take a look at what one of our valued customers has to say:

Francesca T.

Accounts Manager

Small-Business

"My client hired Mike and his team to facilitate the movement of their company from QuickBooks and spreadsheets (lots and lots of spreadsheets!!) over to Sage Intacct. This was a big move for us, because we were finally able to put all our apples into the same basket. Mike and his team were always easy to get a hold of despite us being in separate time zones. They answered our questions the same day they were asked or always acknowledged receipt and told me, hey we are working on it. I feel like with a big transition like this, communication is key, and it's important as the client to feel like you are being heard." Read the full review.

Sage Intacct continues to be recognized by the leaders in industry standards:

The AICPA and its subsidiary, CPA.com, named Sage Intacct as its first and only preferred provider of accounting applications.

The first and last financial management and accounting solution your business will ever need.

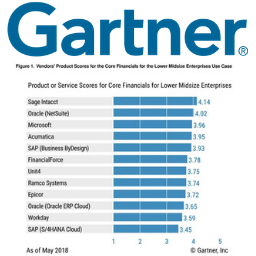

Sage Intacct financial management software receives the highest product score for Lower Midsize Enterprises Use Case ($50 million to $500 million).

DeRosa Mangold Consulting is a trusted team dedicated to partnering with you in a logical fashion to help you make the best decision for your company’s future growth. On average throughout multiple industries, startups to mid-sized organizations begin to see a return on investment in about 6 months. We will personally sit down with you and crunch the numbers, so you know when to expect your own ROI. We won’t tell anything but the truth so that you can make the best decision for your organization.

Want More?

Contact us to learn more about our desire for resolving accounting problems and how it motivates us to deliver innovative solutions for everyone we work with!

To learn more about DeRosa Mangold Consulting or Sage Intacct visit: