The Top Five Limitations of QuickBooks

For many small and mid-sized businesses, Intuit QuickBooks® was the first choice for financial software in an organization’s early days. QB offered basic functionality that almost any business could use to get off the ground.

Virtually every growing business soon realizes that QB has limitations. Here are the top five limitations that cause CFOs to look for an alternative.

1. Over-Reliance of Spreadsheets to Support Financial Processes and Reporting

Many organizations naturally and gradually develop sophisticated accounting requirements such as revenue recognition and multi-entity consolidation. If QB is the financial foundation, that often means cumbersome workarounds because it does not provide the built-in capabilities for complex processes.

- Are you exporting data to multiple spreadsheets?

- Are you creating additional journal entries each month?

- Have you created home-grown applications for recording revenue or expenses outside of QuickBooks?

These workarounds lead to entry errors, incorrect or outdated data, process inefficiencies, wasted time and resources, and a lack of control and compliance.

2. Excess Manual Data Entry and Re-Entry

“I currently spend many hours manually creating invoices in QB. There should be a better way.”

Most companies don’t integrate QB with other key business applications, opting instead to manually integrate the systems (think flat files, CSV dumps, and rekeying). That might suffice when volumes are small, but it’s a productivity killer as the business grows. Who has time to manually research, re-enter, and verify data already captured elsewhere? These manual integrations are invitations to errors and wasted time.

3. Limited Access to Reports and Information to Drive Decision-Making

“We constantly struggle to keep up with incoming requests for data to report financials in a timely manner.”

Real-time visibility into business metrics is essential for timely decisions that boost performance. QB offers canned reports – and no dashboards – so visibility is limited forcing you to make decisions based on outdated data. By leveraging a financial system that incorporates both a multi-dimensional general ledger and report writer, you can transform your analysis. Finance becomes a strategic partner who generates insights that answers the bigger questions facing management.

4. Difficulty in Adapting to New Business Requirements

“QuickBooks continues to crash, and I lose all our payroll data. I don’t have time to re-enter data for 350 hourly employees…”

Classic signs you’ve outgrown QB?

- Menus and screens that used to be quick and responsive now have lengthy delays.

- The system struggles to keep up with data volume and calculations intensity.

- Report-printing takes forever.

- Queries seem to dim the lights.

- Periodically shutting down QB to maintain data files.

In a worst-case scenario, these signs can have potentially disastrous results including system crashes and the loss of crucial data. That is no way to run a business!

5. Inadequate Controls Around Financial Processes

Manual processes are a fact of life with QB. Unfortunately, they increase the probability of data duplication and data entry errors, making it difficult to gain an integrated, real-time financial view of a company’s end-to-end operations.

QB simply wasn’t designed for growing organizations that need advanced functionality to manage sophisticated processes.

The Next Wave of Financial Management Technology

DeRosa Mangold Consulting has helped many businesses make the move from QB to a more advanced software service -- Sage Intacct. Clients benefit from dynamic, real-time data and processes, and flexible reporting in a dashboard delivery system that puts it all at their fingertips. They experience increased productivity through accounting automation, extensive integration and user-defined process flow technology that keeps up with the growth of the company. Sage Intacct is a dimensional accounting system, a new paradigm that will forever change general ledger accounting and ranked #1 in customer satisfaction and we know it will work for you.

Call Gina at (254) 772-2980 or by email at gina@derosamangold.com to explore Sage Intacct as your future financial accounting solution. To see the software – register for a quick daily demo by clicking the button below.

DeRosa Mangold Consulting is a trusted team dedicated to partnering with you in a logical fashion to help you make the best decision for your company’s future growth. On average throughout multiple industries, startups to mid-sized organizations begin to see a return on investment in about 6 months. We will personally sit down with you and crunch the numbers, so you know when to expect your own ROI. We won’t tell anything but the truth so that you can make the best decision for your organization.

Take a look at what one of our valued customers has to say:

Francesca T.

Accounts Manager

Small-Business

"My client hired Mike and his team to facilitate the movement of their company from QuickBooks and spreadsheets (lots and lots of spreadsheets!!) over to Sage Intacct. This was a big move for us, because we were finally able to put all our apples into the same basket. Mike and his team were always easy to get a hold of despite us being in separate time zones. They answered our questions the same day they were asked or always acknowledged receipt and told me, hey we are working on it. I feel like with a big transition like this, communication is key, and it's important as the client to feel like you are being heard." Read the full review.

Want More?

Contact us to learn more about our desire for resolving accounting problems and how it motivates us to deliver innovative solutions for everyone we work with!

To learn more about DeRosa Mangold Consulting or Sage Intacct visit:

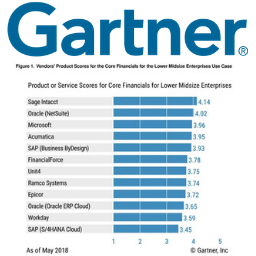

Sage Intacct continues to be recognized by the leaders in industry standards:

The AICPA and its subsidiary, CPA.com, named Sage Intacct as its first and only preferred provider of accounting applications.

The first and last financial management and accounting solution your business will ever need.

Sage Intacct financial management software receives the highest product score for Lower Midsize Enterprises Use Case ($50 million to $500 million).