The Rise of the Data-Driven Nonprofit Finance Leader

The Evolving Role of Nonprofit Financial Leadership

Time is the scarcest resource of today’s nonprofit finance leaders.

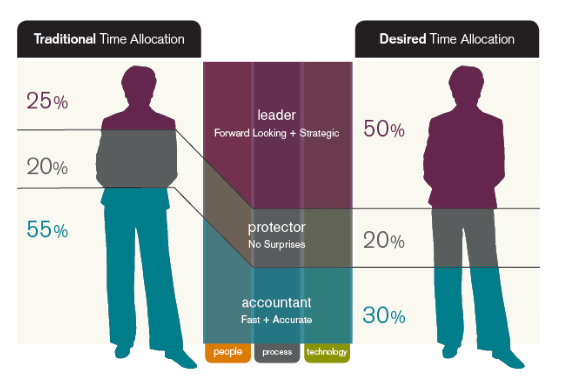

As a nonprofit finance leader, you need to find ways to get away from day-to-day accounting tasks and create time for strategic executive priorities. Recent surveys show that on average, finance leaders set a goal of spending 50% of their time working on strategy.

Instead, 75% of their days are consumed by routine accounting work and protecting the organization against risks. Lacking time to focus on the big picture, 34% of executives make important decisions either reactively (9%) or after putting it off (25%) until the decision can wait no longer.

As a finance leader, you need to streamline the “accountant and protector” processes, so you can make more time for forward-thinking strategy.

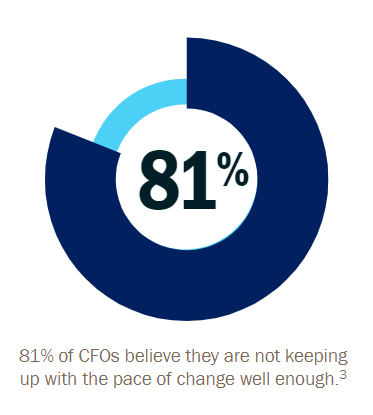

You need to free up time to synthesize your own intuition and experiences with an understanding of your organization’s data, trends, and history. When surveyed, 77% of senior finance leaders recognize the need for a data-driven finance function to achieve strategic goals.4However, 64% also admit their finance function is not proactive enough in using data and analytics to identify, prioritize, and address critical issues.

How to Become a Data-Driven Strategist

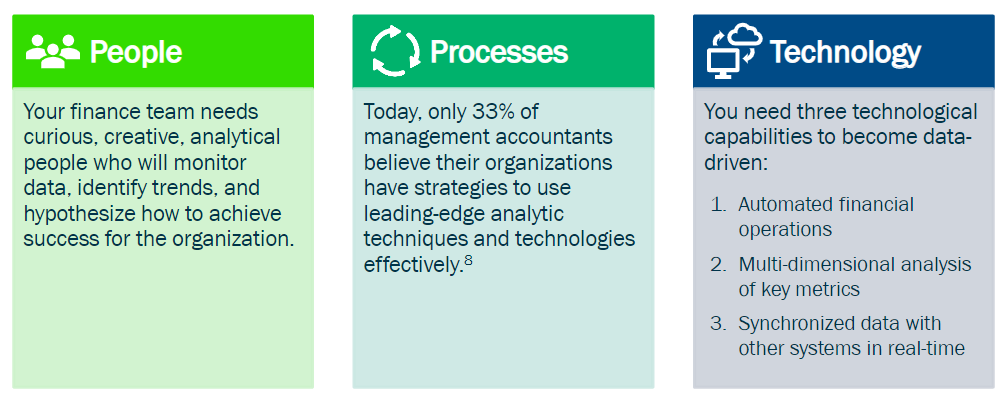

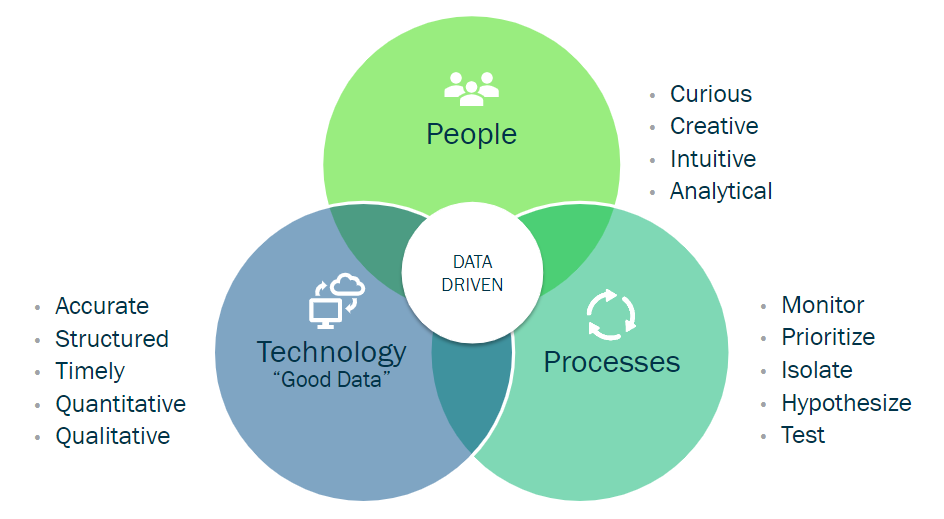

To become a data-driven strategist, you need certain kinds of people, processes, and technology.

Automation Frees Time for Nonprofit Finance Leaders to Focus

Finance leaders understand that automating standard accounting tasks enables more strategic decision making. That’s why 85% plan to invest in process automation.

Organizations are looking to CFOs for strategic leadership:

- 78% of CFOs have noticed their influence expanding beyond accounting and finance.

- 87% of CFOs surveyed feel pressure to collaborate on cross-functional initiatives.

There are so many ways that a real-time cloud financial management solution like Sage Intacct can improve efficiency and accuracy. Financial automation can reduce or eliminate the time nonprofit organizations spend:

- Consolidating financial information in Excel for multi-entity, multi-location, and multi-currency organizations.

- Calculating revenue recognition in Excel after compiling project-based time and expense information from sales and HR systems.

- Performing manual data reconciliations and/or manual data re-entry between systems.

- Calculating allocations using data that doesn’t exist within some traditional accounting systems.

- Processing vendor payments and manually routing paper approval sheets.

Go Beyond GAAP Reporting with Multi-Dimensional Analysis

Data-driven nonprofit organizations make the GL the center of their data strategy.

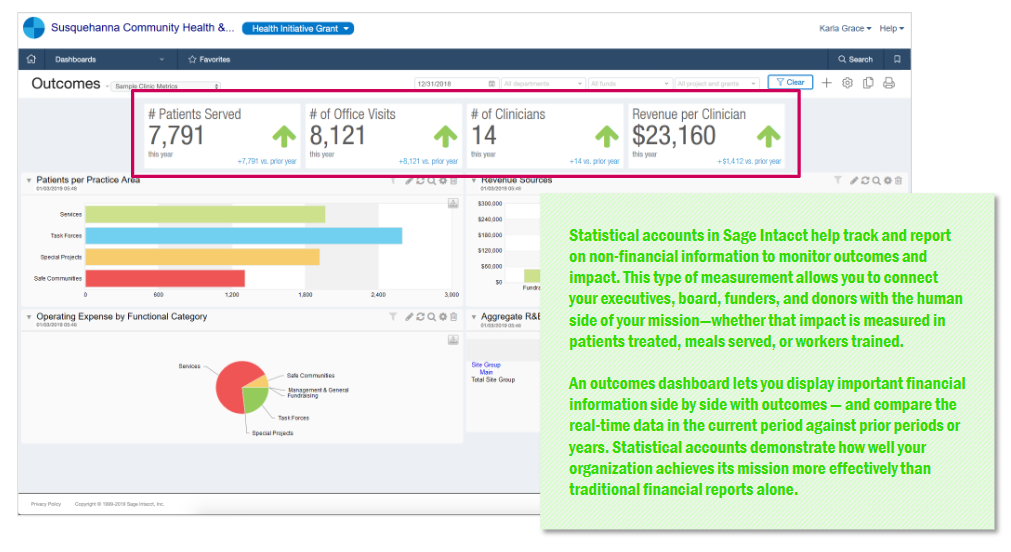

The GL already contains the key financial information needed to create GAAP financial reports, including an organization’s income statement, balance sheet, and financial ratios. By enhancing the GL with non-GAAP statistical data, nonprofits can track and report on key metrics that reflect your organization’s success in accomplishing your mission.

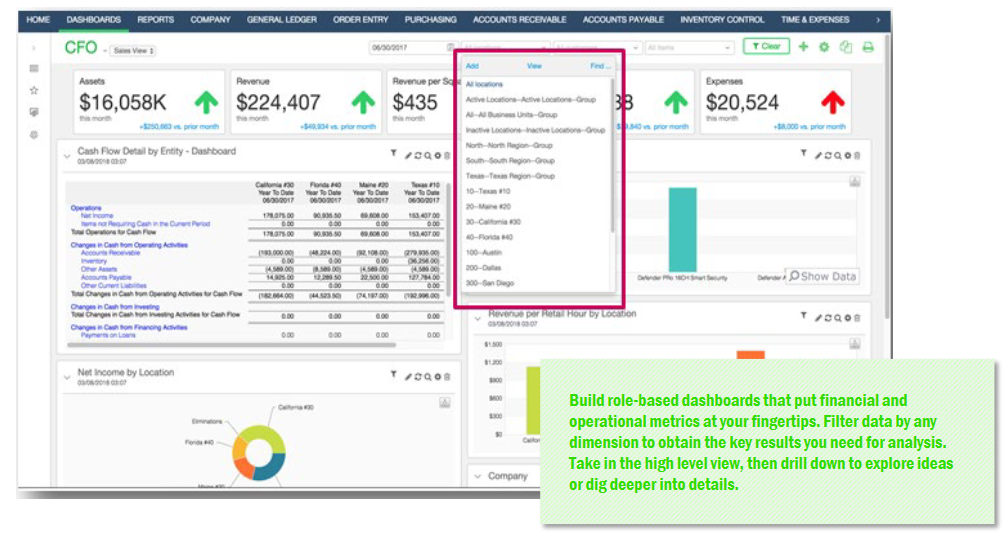

Multi-dimensional analysis brings together your financial data with important operational and funding data to give wider visibility across your organization. Decision Support.

Non-financial metrics could reflect program delivery, such as headcount or labor hours from an HR system. Or you may want to measure and report on the impact your organization makes in terms of meals served, patients treated or educational courses delivered. You could also include donation and funding data from your donor management system.

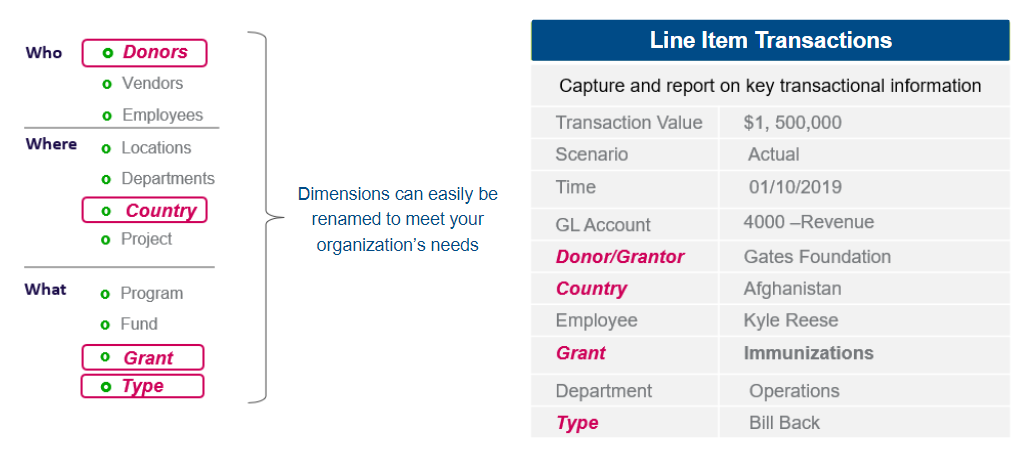

Adding dimensionality to your Chart of Accounts creates greater simplicity and richer contextual data.

Think of dimensions within your Chart of Accounts like hashtags on Twitter. Dimensions make it easy to search, sort, and slice and dice your data for reporting with context that is meaningful for your specific organization.

Just as you can look at hashtags over time, you can analyze your financial reports over time. Just as you can view real-time trending Twitter statistics, you can analyze your financial performance across one or more entities in a real-time dashboard.

Sage Intacct dimensionality lets you organize information by the attributes that matter most to your mission—program, impact, location, grant, and more. Dimensions help you perform a more meaningful analysis of your organization’s performance.

Leverage dimensional data to slice and dice your data for maximum visibility and impact.

Real-Time Multi-Dimensional Analysis of Key Reports

All of Your Real-Time Data, in One Place

Sage Intacct was designed to make it easy for nonprofits to synthesize information from many data sources for more-informed analysis and decision making.

Sage Intacct Application Programming Interfaces (APIs) were designed for real-time integration. Our APIs don’t require you to wait for accounting to post the entries. APIs power our best-in-class ecosystem with prebuilt connectors to popular business systems like Salesforce, ADP and Bill.com. Sage Intacct puts all your data in one place—not just financials—but also sales, planning, payroll data, and any other information you need to drive strategic analysis.

Data-Driven Nonprofit Finance Leaders Deliver Big Results

Using Sage Intacct, nonprofit finance leaders were able to free up time to be more strategic and make impactful decisions. Here are some ways their organizations benefitted.

The pace of evolution in technologies like AI and analytics is quickly accelerating.

Now is the time to push your organization to adopt a more data-driven strategy. Have you hired the right people, built the right culture, and streamlined critical processes? Does your technology generate meaningful, real-time insights or backward-looking reports?

Sage Intacct delivers a rapid transition to financial leadership. Nonprofits benefit quickly from these capabilities:

1.Automation eliminates manual data entry and spreadsheets to close the books faster.

2.Real-time reporting enables proactive response to changing conditions.

3.Aggregate data from disparate sources improves analysis.

4.Role-based dashboards drive decision-making.

Sage Intacct makes it easier to carve out executive time for focused strategic analysis. With a single source of truth and better visibility across the organization, you will be well-positioned to take advantage of financial leadership innovations.

To learn more about how Sage Intacct can help you achieve your mission more efficiently, fill out the following information and DeRosa Mangold will be in touch.

DeRosa Mangold Consulting is a trusted team dedicated to partnering with you in a logical fashion to help you make the best decision for your company’s future growth. On average throughout multiple industries, startups to mid-sized organizations begin to see a return on investment in about 6 months. We will personally sit down with you and crunch the numbers, so you know when to expect your own ROI. We won’t tell anything but the truth so that you can make the best decision for your organization.

To learn more about DeRosa Mangold Consulting or Sage Intacct visit:

If you would like to take a quick look at the software, you can take part in one of the daily Coffee Break Demos we offer.