Are You Ready to be a Tech-Savvy Finance Leader?

Radical Change Is Here

Your business is changing. Your market is changing. Even the macro-economy is changing.

The question is: Are you changing?

For today’s finance leaders, adapting to this new environment is no longer optional. In many instances, the tools, strategies, methods, and tried-and-true metrics you’ve used to run a top-notch financial services organization and forge a successful career—well, they might not be what you need to move forward. So are you content with the status quo, or are you ready to embrace a new role: change agent?

Externally, your markets are pressing you to be faster, smarter, and nimbler. That means using technology to create customer-centric business models. Internally, you need a modern financial infrastructure, faster and more insightful analyses, and the ability to adapt and adopt modern metrics that reflect rapidly emerging business trends and realities. The tremendous resumé you’ve carefully assembled over the years likely isn’t as robust as you need it to be. That’s because, as the finance leader’s responsibilities evolve, technology is playing an increasingly prominent role.

Finance leaders are being called upon to deliver answers that are inescapably dependent on modern, innovative technology. Many of the fundamental assumptions and methodologies that corporate finance has rightly trusted and relied on for decades are undergoing radical, transformative change, and the role of the finance leader will never be the same.

The New Mandate for Finance Leaders: New Rules, New Tools

For finance leaders, it’s no longer about just debits and credits, and yet another spreadsheet. Today, you need to be part analyst, part strategist, part futurist, part collaborator—and all business. You want to be the leader who can modernize and transform business systems and operations to improve productivity. And, you want to be the leader who can adapt to the new rules and the new tools to keep the company ahead of the competition.

Are you ready? You'll need a complete rethink of your financial and technology infrastructure, because shifting business strategies are rewriting the ways companies execute their financial processes and operations. In this new world, you’ll need to:

- Analyze exponentially greater volumes of data

- Embrace the power of social media, mobile users, and cloud computing

- Tap into unlimited and ubiquitous connectivity

- Capitalize on sophisticated databases and analytics

- Adopt new metrics for operations and valuations

In other words, you need to be a tech-savvy finance leader.

But even if you don't have in-depth tech fluency (and few finance leaders do), it's still essential to have some basic knowledge about how technology can positively impact your company—how it can provide competitive differentiation, improve finance's productivity, open up strategic opportunities, and ensure a healthier bottom line. Let's quickly review how you can start to make that happen.

The Tech-Savvy Finance Leader: A Profile

Embrace Automation

If your finance team is hampered by manual processes, you end up needing more people who do less work using bad data to create faulty reports. But if you’re looking to be that future-ready finance leader, it’s time to get your head out of your spreadsheets and break the vicious circle of inaccurate data, lengthy closing cycles, and delayed decisions that lack a fuller context.

A tech-savvy finance leader embraces automation to streamline the mundane tasks and devote

time and resources to the higher value, strategic activities. Technology keeps the bad things from

happening and avoids the endless cycles of tactical tasks. The tech-savvy finance leader makes

informed decisions that drive profit-creating business activities instead of acting as gatekeeper and number cruncher. Think of technology as the guardrails on the road that let you drive faster with your eyes focused on the future with greater confidence that you can avoid the crashes. Automate the accounting, record keeping, and report generation... and the strategic visibility will follow.

Take it to the Cloud - with Security

In the eyes of many, the capital and operating costs of on-premises software are inexorably leading it to the dustbin of corporate technology. Given the many headaches of monolithic software and multiyear implementation and update cycles, it's easy to conclude that "playing it safe" is no longer equivalent to "playing it smart." The status quo itself is a risk.

But being a tech-savvy finance leader also means having the ability to resist rushing into strategic decisions until all the facts are in. Yes, cloud computing is attractive, but you want to be sure you're armed with all of the facts about the risks and benefits of cloud solutions before making rational, informed decisions.

When it comes to cloud computing, many finance leaders are still in the education and evaluation

stages. With so much at stake (as in: the future of your business) and so much in flux, the responsible path is to evaluate all your options and all of the dimensions of this decision— cost, security, scalability, and the essential ability to adapt to fast-changing business conditions. Whether cloud is right for you or not, you need to do your diligence:

- Decipher the Technology - You want to understand cloud—as it relates to your business—and

confirm that the cloud is right for you, without the tired arguments and vendor FUD.

- Assess the Value of the Cloud – Implemented properly, the cloud can and should be more than just a delivery method or a cost saver. The tech-savvy finance leader knows that what matters is how you can unleash new levels of automation, collaboration, and visibility.

- Get a Clear-Eyed View - The tech-savvy finance leader understands more than just the basic risks and opportunities of going to the cloud. Tailoring applications, adding enhancements, and integrating with other platforms and systems—the cloud makes best-of-breed a simpler reality. Given these advantages, it's not surprising to see a growing number of finance leaders opting for best-of-breed cloud solutions to meet escalating business and technology needs.

Be Agile, Not Fragile

As a finance leader, it’s your job to think long-term, even when technology keeps changing in the short-term. The watchwords are agility and future-proofing, because you must make the right decisions that set up the company for success—regardless of what the future brings—even if that's two or three years down the road. While finance leaders are bred to embrace prudence,

it's equally true that acting with boldness while others hesitate can create exceptional advantages.

Make choices that don't limit growth—keep your options open and your business agile to adapt to an unknowable future.

Foster Collaboration

The tech-savvy finance leader's ultimate responsibility is to drive the organization from intent to action to results. But no single individual or group can achieve that in isolation. Delivering faster and smarter outcomes requires the skill sets of a vast range of talented people from across the organization.

The fact is, the business of the future is not well served by outdated silos and independent specialization. Collaboration closes the gaps and sidesteps the pitfalls. It removes organizational friction and tears down barriers that inhibit progress. Collaboration moves you from talking about it to figuring it out to implementing the right actions.

Tech-savvy finance leaders know that new-breed technology provides the foundation for streamlined collaboration that empowers people to engage and innovate.

Pursue Visibility

Business success is often predicated on the ability to look backward and forward. You need to know what's happened—good or bad—and assess your company's performance clearly. The tech-savvy finance leader strives to go beyond plain old "reliable financial statements." Instead, she wants to use technology to create management insights that identify problems and opportunities faster.

A tech-savvy finance leader empowers everyone to dig deeper and understand the true nature of the business results and uncover new opportunities—all drawn from a single system of record. And it's a wise and secure finance leader who's comfortable with delegating this level of empowerment—while still retaining control.

Technology gives new power to interrogate—your business, your projects—in ways that will never happen with spreadsheets or other manual systems. (When it's time to tell the Board what you've found and what needs to happen, do you want to be praying that every cell in every spreadsheet is exactly right?) Your business can't prosper until you find and address the root causes of its challenges. That's why visibility—not merely reporting—is an imperative for finance leaders.

The New Currency for Finance Leaders

Moving forward into rapidly changing markets, finance leaders are under increasing pressure to rethink how they serve the business strategically and operationally. Forward-thinking finance leaders know: A gap is emerging between the tech-savvy and the tech-laggards.

The time is now to develop a game plan to modernize finance and achieve the right level of readiness that meets the modern business mandate. As you prepare to learn more and address this challenge head-on, it quickly becomes apparent that smart solutions to support thoughtful ideas, collaboration, and innovation are the new currency.

Take a Coffee Break with Sage Intacct

If you'd like to learn more about Sage Intacct and what it can do for you, register for the

Sage Intacct Coffee Break Demo

below and see what's possible!

Find out why Sage Intacct is the best choice for your business.

Gina of DeRosa Mangold Consulting explains why you should at least take 45 minutes to watch the Intacct Demo to discover what it can do for your business.

Take a look at what one of our valued customers has to say:

Francesca T.

Accounts Manager

Small-Business

"My client hired Mike and his team to facilitate the movement of their company from QuickBooks and spreadsheets (lots and lots of spreadsheets!!) over to Sage Intacct. This was a big move for us, because we were finally able to put all our apples into the same basket. Mike and his team were always easy to get a hold of despite us being in separate time zones. They answered our questions the same day they were asked or always acknowledged receipt and told me, hey we are working on it. I feel like with a big transition like this, communication is key, and it's important as the client to feel like you are being heard." Read the full review.

DeRosa Mangold Consulting is a trusted team dedicated to partnering with you in a logical fashion to help you make the best decision for your company’s future growth. On average throughout multiple industries, startups to mid-sized organizations begin to see a return on investment in about 6 months. We will personally sit down with you and crunch the numbers, so you know when to expect your own ROI. We won’t tell anything but the truth so that you can make the best decision for your organization.

Want More?

Contact us to learn more about our desire for resolving accounting problems and how it motivates us to deliver innovative solutions for everyone we work with!

To learn more about DeRosa Mangold Consulting or Sage Intacct visit:

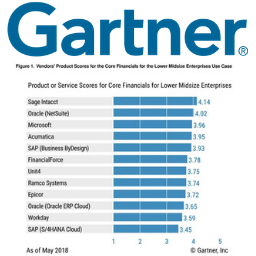

Sage Intacct continues to be recognized by the leaders in industry standards:

The AICPA and its subsidiary, CPA.com, named Sage Intacct as its first and only preferred provider of accounting applications.

The first and last financial management and accounting solution your business will ever need.

Sage Intacct financial management software receives the highest product score for Lower Midsize Enterprises Use Case ($50 million to $500 million).