A 5 Step Plan for Selecting the Right Fund Accounting Software for Your Nonprofit

Six common reasons to change fund accounting software

If your organization struggles with these six challenges, you might have outgrown your current fund accounting system.

- Reporting is a struggle that takes too much time.

- Your organization relies too heavily on inefficient, error-prone manual processes.

- You depend on unwieldy spreadsheets to analyze performance, sometimes causing reporting errors or version control problems.

- The number of your locations, programs, grants, and/or projects has grown rapidly and, as a result, you’re considering adding additional accounting

- Backward-looking reports no longer cut it for making Management and the board need real-time visibility, as do external third parties.

- You need to perform consolidations.

If your team deals with any of these challenges, it’s time to consider changing your fund accounting system. Even if you decide to stay with your current system for now, evaluating all your options unlocks invaluable insights about your organization’s future needs.

Use this guide to walk through a step-by-step plan for defining your requirements, building a business case, and evaluating your options.

Step 1: Get started

Before you begin evaluating fund accounting software, set up your organization for success.

There are six tasks involved in getting started with your search for a new software solution:

1.Obtain executive buy-in. You need executive and/or board agreement about the need for a new system before starting the process.

2.Provide leadership. Ask someone with authority in the accounting department to lead the evaluation team.

3.Set clear goals. Define what you expect to accomplish with the selection of new software. Consider process, performance, and outcome goals.

4.Assemble a project team. Choose a group of people to help drive the evaluation process. Include a variety of user roles, including both management and staff.

5.Involve end users. Define your requirements for selecting a new system. You will also need to evaluate vendors to find the best system for your organization. End users should be part of both conversations.

6.Create a project schedule. The schedule for selecting a new system will vary by organization, depending on organization size and the complexity of requirements.

Step 2: Define your requirements

Before considering your software options, take time to define your requirements.

Document the issues and challenges you’ve experienced with your current system. Next, prepare a top-down strategy for defining your requirements. Ask the following five questions:

1.What do we want to achieve with our new system?

2.What type of information does management need to make better decisions?

3.How many employees/stakeholders need to access the system?

4.Which processes do we want to automate?

5.What other applications are we using (fundraising, donor management/CRM, church management, grants management, etc.)? Does the accounting system need to integrate with these systems?

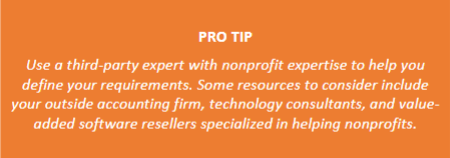

For additional insights at this early stage of planning, tap into your network of peers and colleagues —especially those who have recently evaluated fund accounting software. Ask how they identified their critical requirements

Finally, document the improvements you expect to experience with a new fund accounting system. What do you expect in terms of Return on Investment (ROI) and Total Cost of Ownership (TCO)?

Four key areas every CFO thinks about

Choosing fund accounting software means more than saving time and reducing data entry. The right system should also deliver real-time visibility and deeper insights for decision-making.

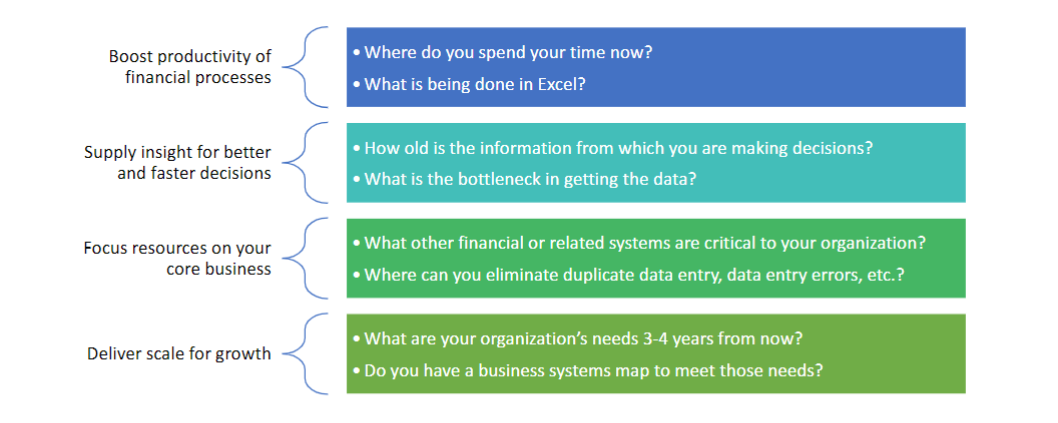

Step 3: Understand your options

For many nonprofits, the software delivery model will be the first major decision in your evaluation.

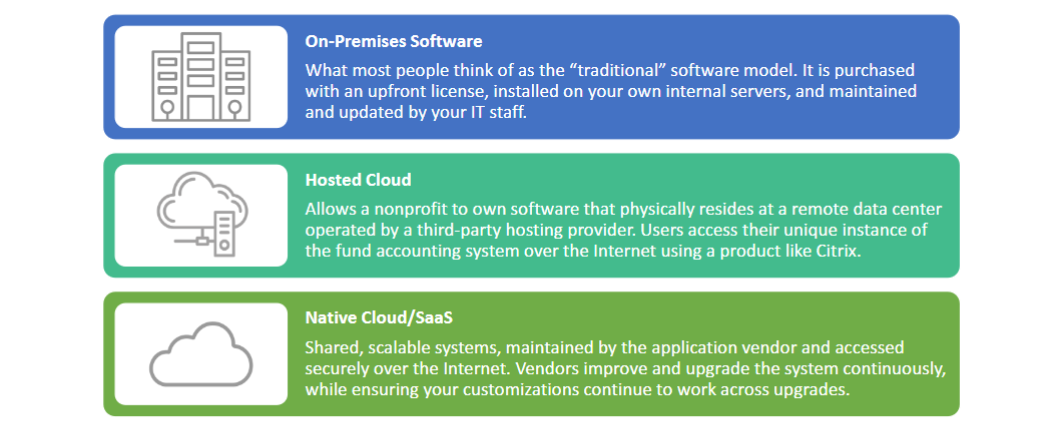

Ensure your functional requirements are met

Every accounting solution that makes your short list for evaluation will need to meet the functional requirements defined by your organization.

Your choice depends on your needs

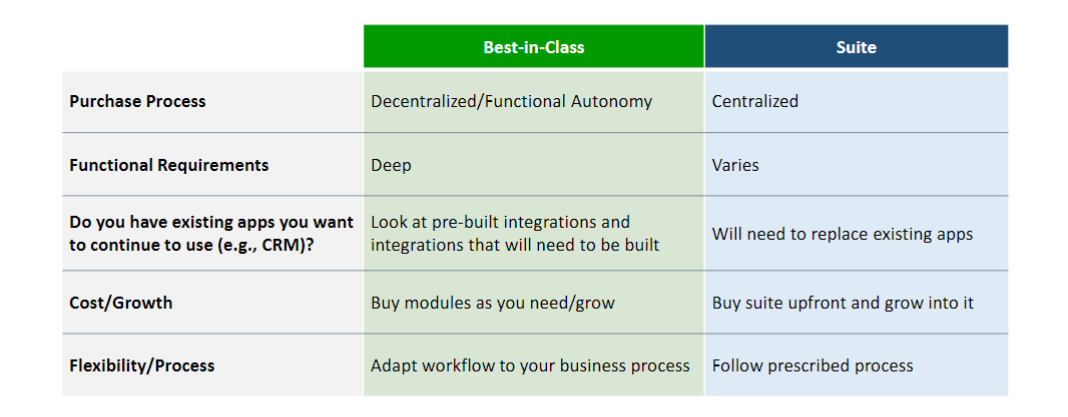

Use this chart to help determine if you prefer best-in -class or suite solutions.

Step 4: Software evaluation process for nonprofits

The software evaluation process helps you determine the solution that best solves your organization’s challenges at the lowest cost and risk.

- Review vendor reputation by checking online sentiment, accounting publication reviews, and product endorsements, such as from the AICPA. Check recent industry awards. Inquire about the customer satisfaction rate and customer renewal rate.

- Check solutions against functional requirements to assess how closely each system fits your needs.

- Create a short list of the solutions that meet your requirements and have reputable vendors.

- Watch a demo and/or take a free trial of each solution on your short list, noting ease of use, functionality, efficiency gains, etc.

- Quantify the benefits by calculating your expected Return on Investment (ROI) and Total Cost of Ownership (TCO).

- Check references by contacting current customers. Customer success is a great way to judge the potential fit for your organization.

Step 5: Calculate ROI and ROM

Develop your business case for a new fund accounting system by identifying how the investment will improve your organization.

You should be able to easily identify where you will see increased productivity and efficiency. Productivity gains will result in time savings and corresponding hard cost savings. For example, if you reduce your month-end close from five business days to two, you have saved three days of your team’s time. Now multiply that by 12 months and add in the savings you’d enjoy in year-end closing.

That’s just the start of what the right fund accounting system can deliver. You’ll also want to consider the value of increased visibility, better donor transparency, more agile decision-making, and fewer mistakes/restatements.

Return on Investment (ROI)

This key performance indicator is the standard most businesses apply to their software purchasing decisions. To calculate ROI, you will determine the value of benefits provided by the software.

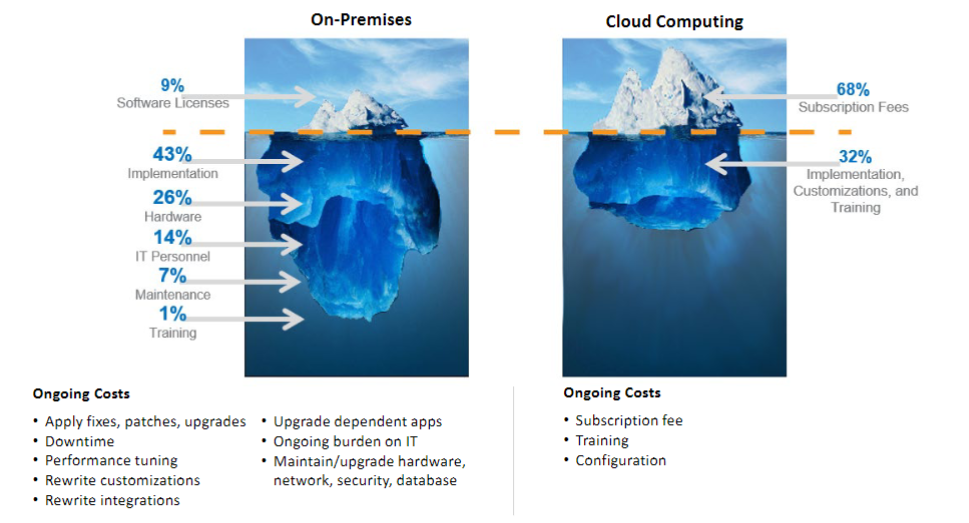

You will also project the Total Cost of Ownership (TCO) (subscription costs for SaaS or licenses and support fees for on-premises software). Finally, you will calculate how many months or years of the software’s benefits it will take to equal the investment made.

Return on Mission (ROM)

Nonprofits need to consider an additional key performance indicator: Return on Mission (ROM). ROM looks beyond the standard ROI formula to make sure your investments have the maximum impact on your mission, not just the bottom line.

ROI in the Cloud vs. On-Premises

Compared to on-premises, cloud applications offer better ROI plus shifts fixed CAPEX to variable OPEX.

Make the best choice for your organization

When it comes to transforming financial management, the benefits of change outweigh the inconvenience of change.

If your nonprofit is struggling under the inefficiency of an outdated or underpowered accounting system, you already feel the pain. The extra work involved to evaluate software and build a business case will be worth it when your organization strengthens its financial management. Right-sized, full-featured fund accounting software designed for the needs of nonprofits contributes directly to mission impact.

We wrote this blog to help you break the software evaluation and selection process into manageable steps. We hope it has helped you identify your needs, define functional requirements, and determine your potential benefits as you do your homework toward finding the right fund accounting software for your organization.

Interested in learning more?

Visit this webpage and contact DeRosa Mangold Consulting to learn more.

To learn more about how Sage Intacct can help you achieve your mission more efficiently, fill out the following information and DeRosa Mangold will be in touch.

DeRosa Mangold Consulting is a trusted team dedicated to partnering with you in a logical fashion to help you make the best decision for your company’s future growth. On average throughout multiple industries, startups to mid-sized organizations begin to see a return on investment in about 6 months. We will personally sit down with you and crunch the numbers, so you know when to expect your own ROI. We won’t tell anything but the truth so that you can make the best decision for your organization.

To learn more about DeRosa Mangold Consulting or Sage Intacct visit:

If you would like to take a quick look at the software, you can take part in one of the daily Coffee Break Demos we offer.