How to Speed Up Your Nonprofit Audit with Audit-Ready Financials

What Goes into a Nonprofit Audit?

The audit of a nonprofit organization consists of two parts: An auditor review of your

GAAP-compliant financial statements, and a separate compliance audit to assess risk and

internal controls.

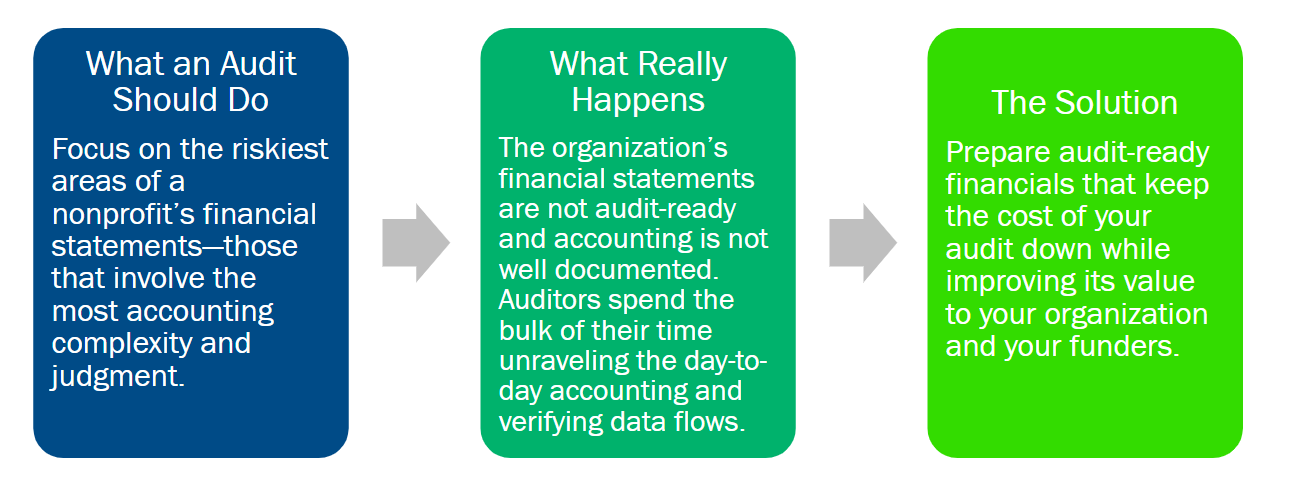

Most financial statement risk in any nonprofit organization comes from errors in judgment or faulty financial management processes. Therefore, an audit will be most beneficial if your auditor can spend more time on your compliance audit to get a better assessment of your organization’s risk.

Risk Assessment Process

The key to audit readiness is well-documented transactions and balances.

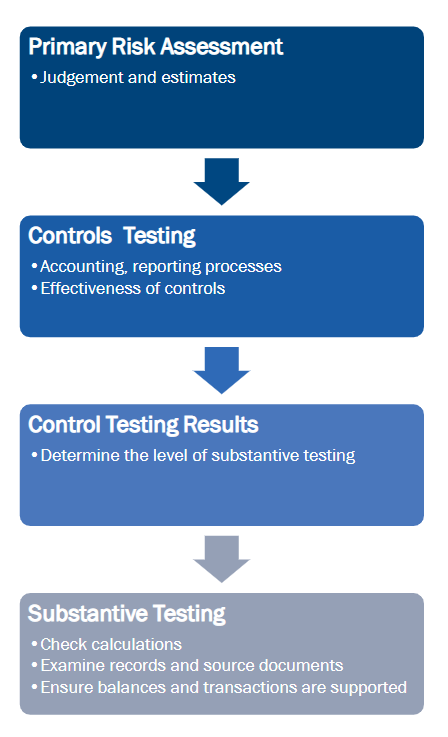

An audit will assess the different types of risk (listed right) to enable the auditor to become familiar with your internal controls and your accounting and reporting processes. The auditor will want to understand where your risk lies in order to issue an informed opinion on your organization’s GAAP conformity.

Effective internal controls reduce the risk of a material misstatement, so testing your internal controls will be an important part of the risk assessment. Based on the result of controls testing, the auditor will then test your accounting and reporting process by:

- Checking calculations

• Examining records and source documents to support balances and transactions

• Confirming certain balances and transaction with third parties

• Where applicable, physically observing assets

To have audit-ready financials, organizations should thoroughly document transactions and balances within a modern financial accounting system

How to Achieve an Expedient, Cost-Effective Audit

How to Produce Audit-Ready Financials in the Cloud

Preparing audit-ready financials can be easier in theory than in practice if you lack a

modern nonprofit financial management system.

When accounting software is outdated or lacks features, the audit process quickly becomes mired in sorting through the accounting records rather than identifying risk.

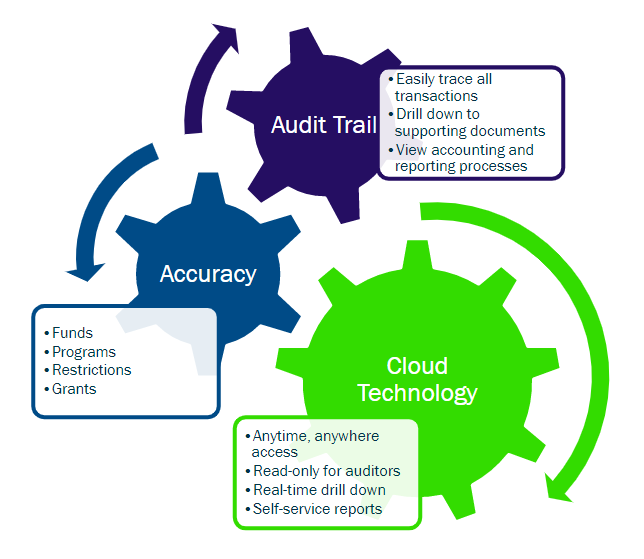

Modern cloud accounting software will save your finance team and your auditor a significant amount of time and prove to your key stakeholders that your financial statements are audit-ready.

Modern cloud accounting software streamlines and automates:

- The organization of funding sources

- The documentation of accounting treatments

- The calculation and reconciliation of all figures

- The closing and consolidation of the books

- The preparation of financial statements

Get Organized

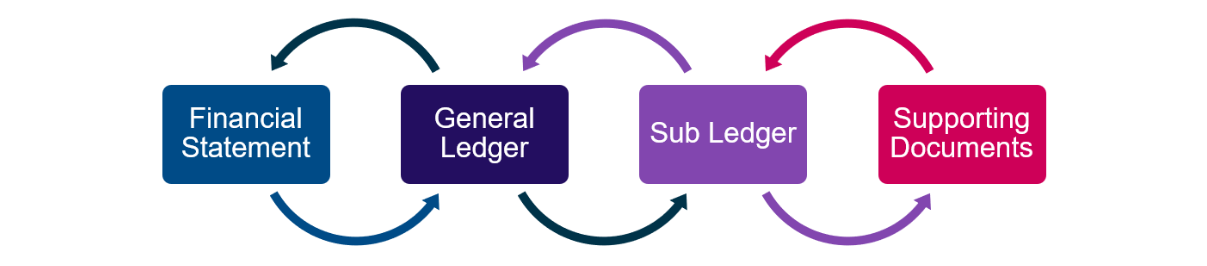

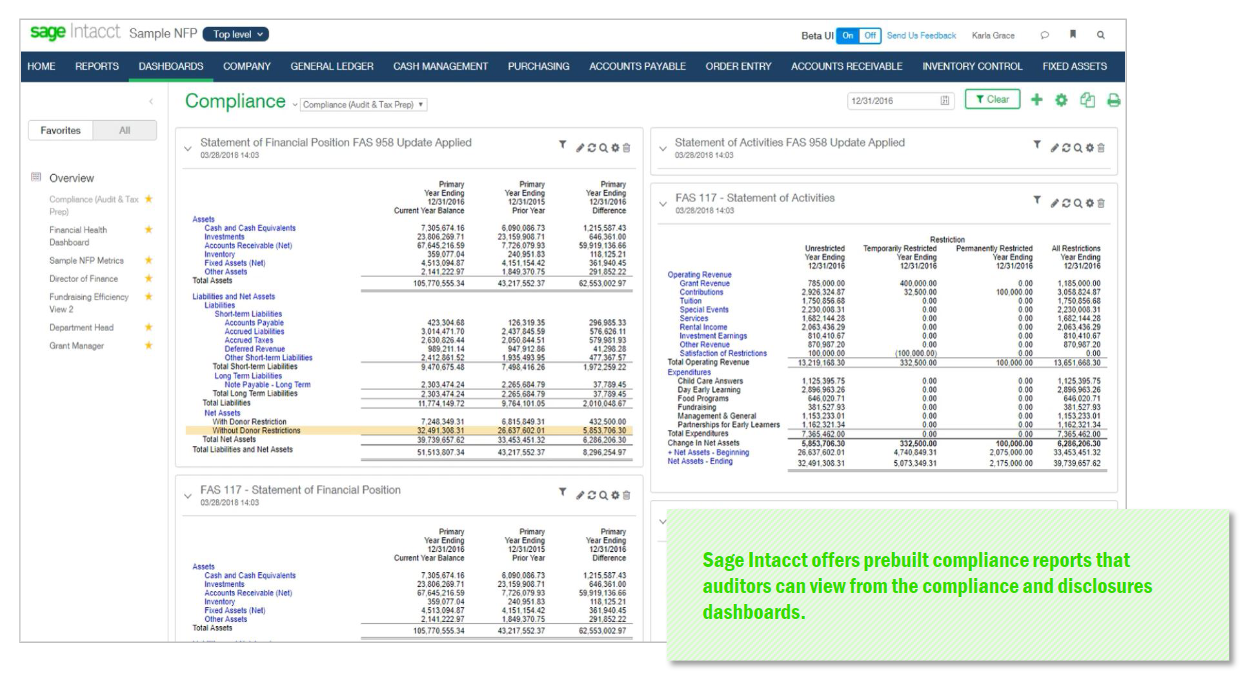

A modern cloud financial management solution, like Sage Intacct, organizes transactions so you and your auditors can easily trace transactions from the financial statements to the general ledger to the sub ledger to the supporting documents, and back again.

Using an accounting system that is purpose-built to manage and demonstrate the accounting path will set the stage for both you and your auditor to have a positive audit experience. By establishing a clear and complete audit trail from transaction to report and reconciliation, auditors will be able to easily and effectively test your organization’s accounting processes.

Gain Visibility and Transparency

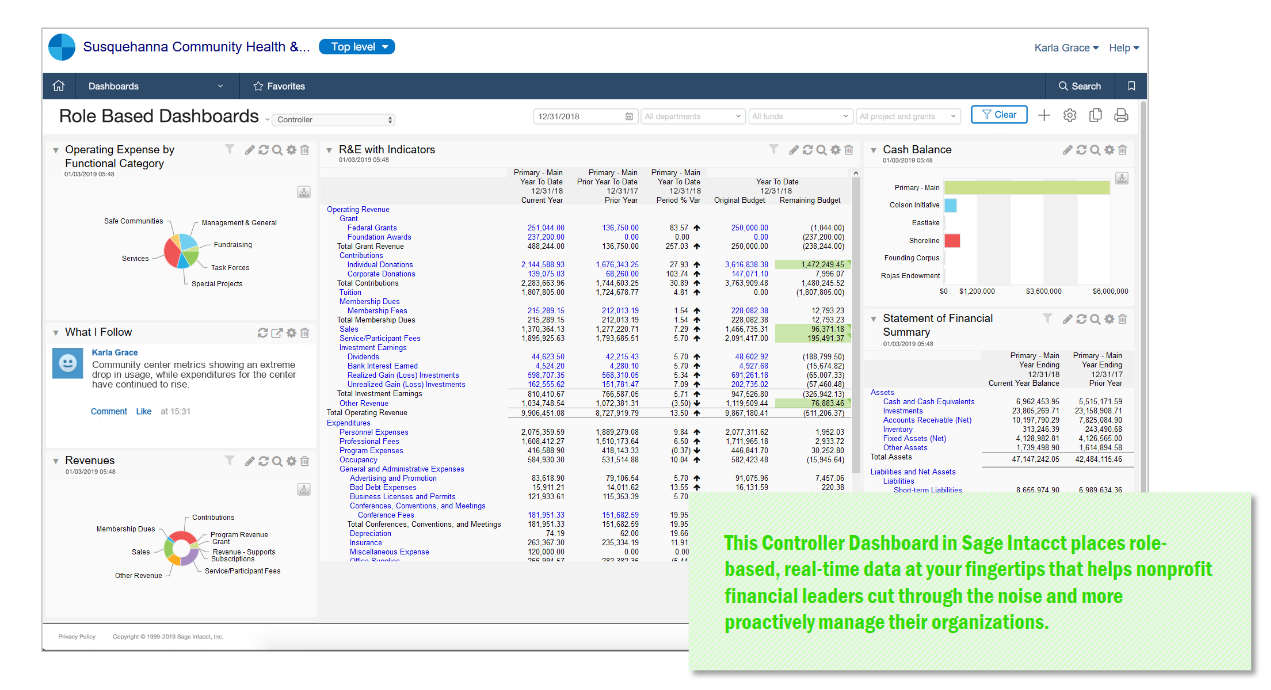

When your auditor asks for additional information, you need to be able to provide it quickly to keep the audit moving forward.

If you have to wade through file cabinets, multiple spreadsheets or export/import data out of another computer program, it will slow down your audit and make it more costly.

A modern cloud financial management system can provide access to real-time financial data to everyone in your organization that needs it, including your outside auditor. Your team can still work at the same time the auditor is working, minimizing distractions and keeping your team focused on achieving your mission.

Gain Visibility with Role-Based Dashboards

Speed Up the Process

Reducing audit time also reduces audit cost.

Once your accounting process is well-documented and auditable, you need to present your financials, reconciliations, and supporting documents to your auditors in a timely manner. Cloud accounting software speeds up accounting period closes through automated calculations that eliminate the inefficiencies and inaccuracies associated with manual spreadsheets.

You can also speed up your close through the use of multiple sub ledgers for each of your organization’s entities or locations. You can close a sub ledger before you close the full general ledger, allowing your auditor to get started sooner in riskier areas, like receivables. This provides your auditor with extra time for testing in higher risk areas while allowing the audit work and your financial close process to occur simultaneously.

Save Time with Compliance Dashboards

Leverage Automation

Leverage the power of automation in a cloud accounting system to improve accuracy and lower the time and cost involved in an audit.

Grant auditors permission to log in from any location and gain read-only access to review all of your data for predefined periods. Auditors can click on any figure in the financial statement and drill all the way down to the general and sub ledgers, reports, reconciliations, and original transactions to test key accounting processes. They can run built-in reports and reconciliations on demand, achieving a higher level of confidence in transactions.

Attach supporting documents to any transaction, so the auditor can view source documents. This self-service model for reports and documentation speeds up the audit, allowing the auditor to investigate without coming to you with questions.

Reap the Benefits of Audit-Ready Financials

Audits are never fun, but they are necessary in order to achieve funding and provide the transparency and compliance expected of well-managed nonprofit organizations. A modern cloud accounting system can help you prepare audit-ready financials and improve the efficiency and cost effectiveness of an audit while minimizing the day-to-day disruption.

Sage Intacct helps you establish solid accounting processes, automate financial calculations and financial statement preparation, and provide clear audit trails and documentation to support your accounting treatment decisions to an auditor.

By demonstrating the accounting path and enabling auditors to easily trace transactions and call up their own reports and reconciliations, Sage Intacct helps speed up your audit and potentially reduces its cost, enabling your organization to focus its time and money on advancing your mission.