Driving Nonprofit Finance Efficiency with Paperless Automation

With today’s modern technology, there’s no need for paper in the office.

When the pandemic hit, many nonprofits experienced an urgent need to undergo rapid digital transformation. Cloud business systems helped staff stay productive while they worked from home under government stay-at-home orders. As the world opened back up, it became clear that many of the pandemic’s effects on the way we work and utilize technology will be lasting. What does the “new normal” mean for nonprofit finance teams and the technology supporting them?

All nonprofit leaders strive to be better stewards and help their organizations achieve greater impact. Modern cloud technology enables you to leverage your organization’s data to be able to do more with less while gaining strategic insights that will lead to better return on mission.

When the pandemic hit, many nonprofits experienced an urgent need to undergo rapid digital transformation. Cloud business systems helped staff stay productive while they worked from home under government stay-at-home orders. As the world opened back up, it became clear that many of the pandemic’s effects on the way we work and utilize technology will be lasting. What does the “new normal” mean for nonprofit finance teams and the technology supporting them?

All nonprofit leaders strive to be better stewards and help their organizations achieve greater impact. Modern cloud technology enables you to leverage your organization’s data to be able to do more with less while gaining strategic insights that will lead to better return on mission.

The Future Requires a More Automated Approach

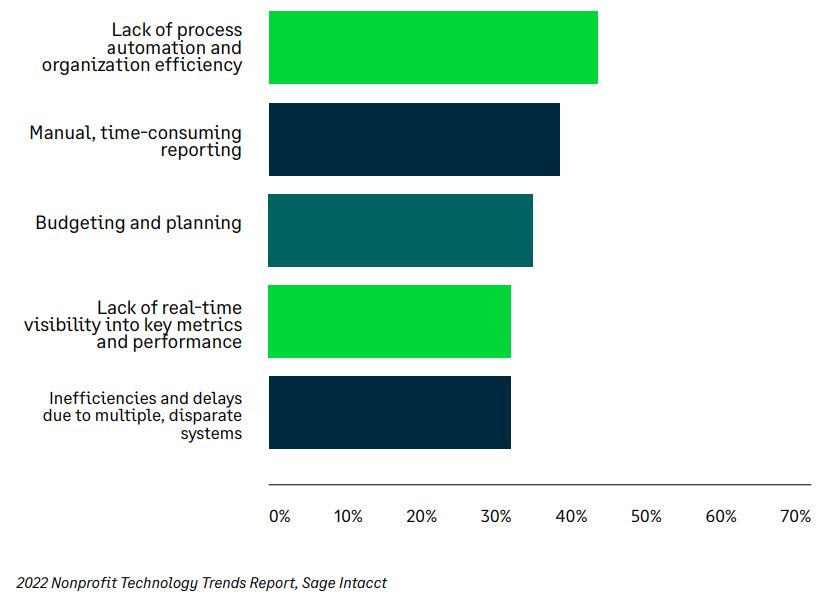

In the annual Nonprofit Technology Trends survey, nonprofit finance leaders said they spend too much time on manual—and often paper-based—accounting tasks and not enough time on strategic work.

For the third year in a row, nonprofit finance leaders bemoaned a lack of automation that hampers productivity and visibility. They find themselves hamstrung by disparate business and financial systems that do not share data and can’t provide the metrics that matter most. To gain efficiency and insight, nonprofit finance leaders need better automation, better integration, and better visibility. A true cloud accounting system like Sage Intacct puts nonprofits on the path to digital finance transformation.

12 Benefits of Paperless Cloud Automation

With real-time data and digital automation, today’s nonprofit finance leaders can drive the organization in ways not possible in the past.

Paperless automation with a cloud financial management system enables nonprofit organizations to:

- Increase operational efficiency

- Improve document organization

- Permit multi-user access, from anywhere, at any time

- Interface with vendors

- Define and automate key financial processes

- Improve security with role-based access and audit trails

- Gain real-time visibility

- Easily slice and dice data

- Speed up entity and location consolidations

- Automate calculation of performance metrics

- View performance and outcomes across systems through integration

- Help the environment

Automated financial operations 5 time-consuming manual tasks it is time to automate

If your finance team spends 75% of the time on transactional accounting tasks and only 25% on strategic work, it’s time to flip that ratio.

Manual consolidations, currency conversions, intercompany eliminations

A cloud solution automates consolidations from any internet-connected location on the planet, calculates currency conversions, and accounts for intercompany eliminations. No more manual manipulation in Excel.

Manual revenue recognition and billing

Stop calculating revenue recognition in Excel after exporting sales data from your CRM system or doing billing worksheets in Excel after manually compiling project-based time and expense information from your labor tracking system.

Manual reconciliation of data between business systems

When you can automatically integrate systems and synchronize the real[1]time data they contain, you will no longer need to manually reconcile data you exported from one system and reentered into another.

Manual allocations

Automate the calculation of allocations that require data from multiple systems, for example, IT costs per headcount or revenue per employee.

Manual vendor payment approvals

Instead of passing paper documents from one person to the next in an approval chain, set up a paperless, automated approval workflow that tracks each step and stores the approvals.

Multi-dimensional analysis Easily sort, slice, and dice your data

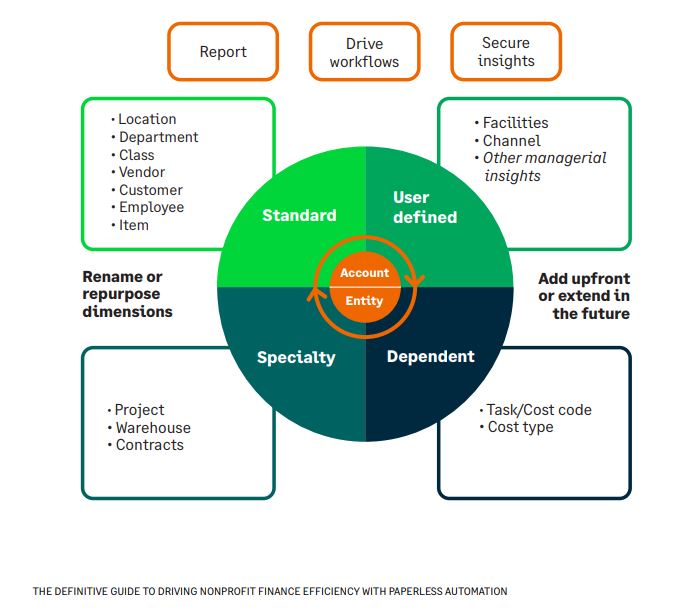

A dimensional chart of accounts helps you ditch Excel spreadsheets and speed up reporting.

Every accounting system has a chart of accounts that allows you to account for time and scenario. But there are other attributes that matter to your organization, such as donor, vendor, location, department, program, grant, and so on.

A dimensional chart of accounts—like the architecture in Sage Intacct—lets you “tag” transactions with the attributes (called Dimensions) most important to your organization. You can tailor the names of these Dimensions to reflect the nature of your operations.

Running a report? Just drop down and select the dimensions you want to see (for example by grant and location) and then filter results. Dimensions make it easy to visualize data in reports and dashboards.

Synchronized data Integrate data for better visibility

The highest use of automation enables you to derive strategic insights from across your organization.

You’ve already seen the power of real-time data within the financial management system. Now imagine the same visibility into data flowing across your organization, thanks to easy, open integration between cloud systems.

Make sure your technology supports Applications Programming Interfaces (APIs) that are easy to use. This functionality is what allows you to “plug and play” between different systems. At Sage Intacct, our engineering team conducts hundreds of thousands of automated tests built on top of the APIs to ensure the integrity and functionality of our best-in-class ecosystem. Sage Intacct customers always enjoy the freedom to choose whichever business applications they want to use alongside their financials.

Leverage automation to drive your mission forward

Make the move to paperless, digital automation and transform your financial operations.

As we’ve seen recently, conditions can change quickly, and it is essential that your nonprofit organization has the right technology to adapt and adjust quickly. In a world of social media fundraising, online donations, work from home, and global nonprofit missions, there is just no place for paper-based, manual processes or data that is not presented in real-time.

A modern, cloud financial management system empowers nonprofit financial leaders to make data-driven decisions and act strategically to drive greater mission impact. Supported by real-time data and paperless automation, organizations can automate financial operations, perform multi-dimensional analysis of key results, and increase both efficiency and responsiveness by being able to synchronize data with other systems in real-time.

About Sage Intacct

Sage Intacct is the AICPA’s preferred provider of cloud financial applications.

Specializing in helping nonprofits of all types—including health and human services, NGOs, charities, trade and membership associations, cultural institutions, and faith-based organizations—Sage Intacct streamlines grant, fund, project, and donor accounting, while delivering real-time visibility into the metrics that matter.

Our modern, true cloud solution, with open APIs, gives nonprofits the connectivity, visibility, and efficiency they need to do more with less. At Sage Intacct, we help nonprofits strengthen stewardship, build influence, grow funding, and achieve mission success.

In addition to intuitive software solutions, Sage Membership provides members with access to actionable human advice from experts and peers through exclusive content and tools to help you make even better mission-critical decisions.

If you’d like to learn more, please contact DeRosa Mangold Consulting to speak with one of our dedicated team members.