5 Telltale Signs Your Nonprofit has Outgrown QuickBooks

The pains of growing beyond the capabilities of QuickBooks

A good fit for a small nonprofit, QuickBooks wasn’t built for the complex needs of an expanding nonprofit.

Many small nonprofits manage accounting operations with small business software such as Intuit® QuickBooks®. QuickBooks is a great bookkeeping solution for small nonprofits, but as your organization grows in size and complexity, you’ll start to feel some growing pains. You might be able to limp along with QuickBooks, but you’d be missing out on the benefits that a more robust system could bring, including:

- Saving tens to hundreds of hours each month on manual accounting tasks.

- Fostering good stewardship with increased data transparency.

- Shortening the monthly close by 30% to 75%

Read on to learn the five telltale signs that your nonprofit has outgrown QuickBooks and what to do about it.

Companies that combined cost-cutting with selective investing before the crisis ended had a 76% chance of pulling ahead of competition, as opposed to companies that solely cut costs.

Opportunity exists even in times of crisis, so let’s explore how revamping your organization’s accounting system can lead to competitive advantages during recovery and beyond.

5 signs you’ve outgrown QuickBooks

Sign 1:

You have insufficient information to make decisions with confidence

“It’s difficult to make data-driven decisions without a real-time view of financial performance.”

Nonprofits have unique reporting needs and often include expense category, project, funding, grant, location, outcome metrics, and activity. If you find it cumbersome and difficult to get the specific view of your data that you need, or if you are constantly exporting, cutting and pasting data into Excel for analysis and reporting – you have probably outgrown QuickBooks.

Solution:

Real-time reporting with automated outcome metrics

You need to be able to provide rapid answers to many stakeholders, from the CEO and board to donors and funders.

Nonprofit executives must leverage every insight they can glean from performance data to better support your organization’s mission in the current environment.

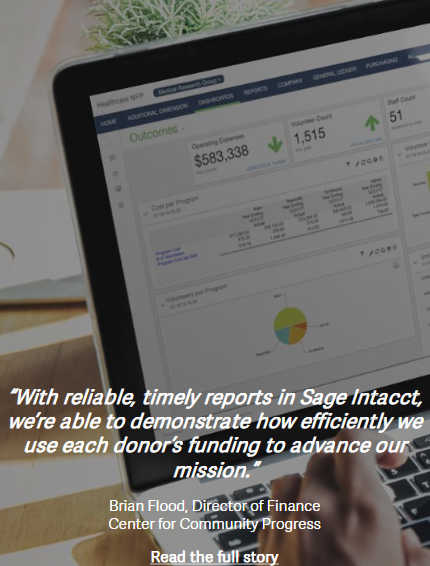

A modern financial management system with a focus on nonprofits will allow you to quickly drill down with instant visibility to any level of detail you need. Sage Intacct makes it easy to slice and dice data for any view needed, resulting in real-time, deep visibility across budgets, transactions, and operational measures. This enables executives to strengthen financial stewardship and make more proactive management decisions.

Sign 2:

Manual processes and spreadsheets have become unwieldy and prone to error

“Cumbersome workarounds have left our team over-reliant on spreadsheets and manual entry.”

Over time, many nonprofits gradually develop sophisticated accounting requirements such as revenue recognition and multi-entity consolidation. If you are using QuickBooks for Nonprofits as your financial foundation, it often means your team is forced to build cumbersome workarounds to complete these complex processes, leaving users over-reliant on spreadsheets and manual entry.

If you have multiple entities, you and your team are logging in and out of multiple instances of QuickBooks daily.

Solution:

Automated nonprofit financial management

Automated, paperless workflows accelerate routine accounting and reporting tasks, leaving more time to focus on strategies that help accomplish your organization’s mission.

Modern accounting systems have built-in automation and workflows that streamline processes to save time and reduce errors while QuickBooks does not provide these built-in capabilities. Sage Intacct increases your efficiency and productivity by:

- Tailoring transactions and approval workflows to eliminate redundant data entry.

- Automatically routing and tracking digital approval signoffs on transactions.

- Automating fund, revenue, and billing processes.

Sign 3:

Information silos have impacted financial visibility

“Our team manually researches, re-enters, and verifies data that’s already captured elsewhere.”

Most organizations don’t integrate QuickBooks with other key applications. It’s very common to see lots of manual integration points between business systems in nonprofits using QuickBooks—which may be fine when transaction volumes are low but is a real productivity killer as the organization grows.

Data silos also mean the inability to easily tie financial data with statistical data for transparency into outcome metrics and other KPIs needed to effectively run your organization and secure funding.

Solution:

Wide visibility through open integration

You can leverage key data from across the organization by choosing a cloud financial management solution that supports effortless integration to best-in-class applications.

Seamless integration with other streams of organizational data will provide executives and other stakeholders with the ability to track statistical metrics that are central to your organization’s operations and programs. Sage Intacct provides users an open API standard to enable nonprofits to integrate cloud-based systems with much less difficulty or expense than traditional software integrations.

With Sage Intacct’s open API web architecture, your organization can easily integrate best-in-class solutions. So, you’re free to choose business applications based on functional fit, instead of integration concerns.

Sign 4:

Your audit trail is insufficient

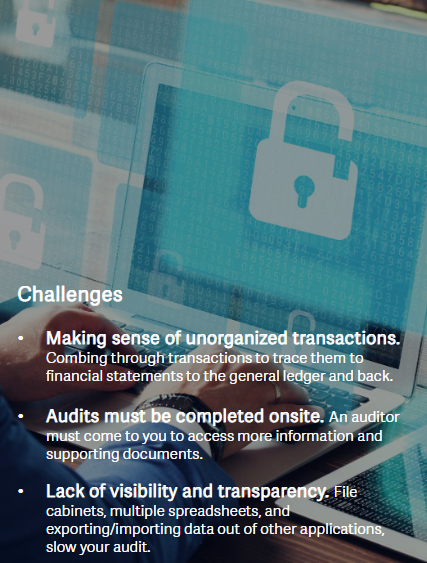

“With multiple funding sources, your monthly close and audit are complex and time-consuming.”

Stewardship and accountability are vital to the sustainability of your nonprofit organization. Whether charity evaluators, constituents, or potential donors, it is critical to have a deep and full audit trail to not only prevent fraud, but to close your books efficiently and ensure that you are achieving the best possible return on mission.

When accounting software is outdated or lacks features, the audit process quickly becomes mired in sorting through the accounting records rather than identifying risk.

Solution:

A modern audit trail

Audit requirements and needs vary across different nonprofit organizations, but all organizations need a modern audit trail.

A modern cloud financial system, like Sage Intacct, establishes a clear and complete audit trail from transaction to report and reconciliation—so auditors will be able to easily and effectively test your organization’s accounting processes.

Once your accounting process is well-documented and auditable, you need to present your financials, reconciliations, and supporting documents to your auditors in a timely manner. Sage Intacct speeds up accounting period closes through automated calculations that eliminate the inefficiencies and inaccuracies associated with manual spreadsheets.

Sign 5:

Your system hinders growth

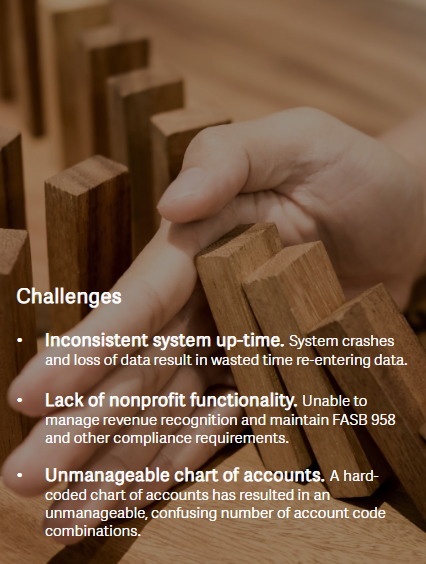

“As we’ve grown, so has our QuickBooks file and it’s become time-consuming to complete even basic tasks.”

As your nonprofit organization grows, you need an accounting system that can grow with you. QuickBooks was designed for the needs of small businesses, not designed to manage the sophisticated processes of a growing nonprofit and does not offer advanced functionality or robust financial controls.

If you are adding or have added additional entities or locations; or have acquired any organizations, it’s a good bet that QuickBooks isn’t serving your needs well.

Solution:

Scalable system that grows with you

Sage Intacct was designed for growth.

It provides your nonprofit with a scalable architecture that allows for increases in transaction volume, the ability to add new entities and ledgers, and financial controls to ensure compliance and auditability.

Reduce complexity by simplifying your chart of accounts using Dimensions. Streamline inter-entity transactions, allocations, eliminations, and financial consolidation, reporting, and analysis with extensive built-in automation and one-click consolidations.

Take advantage of deep support for global nonprofits with automatic multi-currency transactions and reporting. Plus, you can store, manage, and report any data in multiple currencies.

DeRosa Mangold Consulting and Sage Intacct help you automate and scale

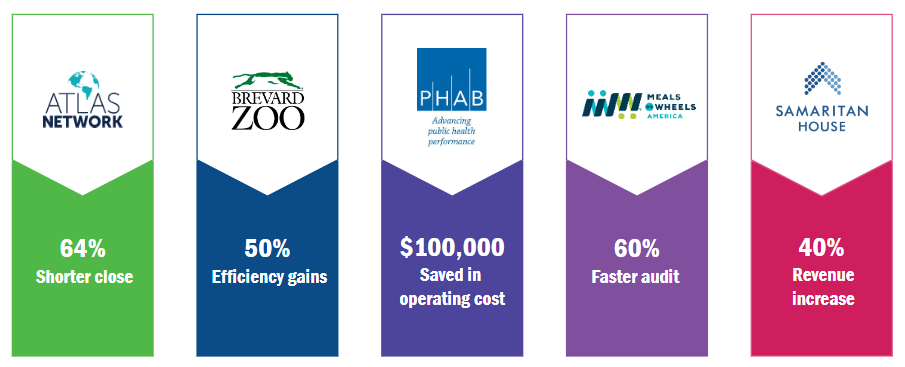

These and more customers graduating from QuickBooks have achieved significant results and expanded their missions.

Accelerate your mission with DeRosa Mangold Consulting & Sage Intacct

Sage Intacct has helped thousands of organizations graduate from QuickBooks.

Specializing in helping nonprofits of all types including health and human services organizations, education organizations, NGOs, trade and membership associations, philanthropic charities, cultural institutions, faith-based organizations, and more, Sage Intacct streamlines grant, fund, project, and donor accounting, while delivering real-time visibility into the metrics that matter. Our modern, true cloud solution, with open APIs, gives nonprofits the connectivity, visibility, and efficiency they need to do more with less. At Sage Intacct, we help nonprofits strengthen stewardship, build influence, grow funding, and achieve mission success.

To learn more about how Sage Intacct can help you achieve your mission more efficiently, fill out the following information and DeRosa Mangold will be in touch.

DeRosa Mangold Consulting is a trusted team dedicated to partnering with you in a logical fashion to help you make the best decision for your company’s future growth. On average throughout multiple industries, startups to mid-sized organizations begin to see a return on investment in about 6 months. We will personally sit down with you and crunch the numbers, so you know when to expect your own ROI. We won’t tell anything but the truth so that you can make the best decision for your organization.

To learn more about DeRosa Mangold Consulting or Sage Intacct visit:

If you would like to take a quick look at the software, you can take part in one of the daily Coffee Break Demos we offer.