3 Reasons to Make Your Planning More Dynamic

Today having a clear picture of your business’s situation is critical with the constant change driven by disruption and market volatility.

We’ve identified three reasons why you need to make your planning more dynamic now. Dynamic planning can help your organization ensure that the right people are continuously involved in the strategic management process, receiving actionable insights in a timely manner to drive the decision making required for your business to weather the volatile storms of today and accelerate into the curve of recovery when business conditions improve.

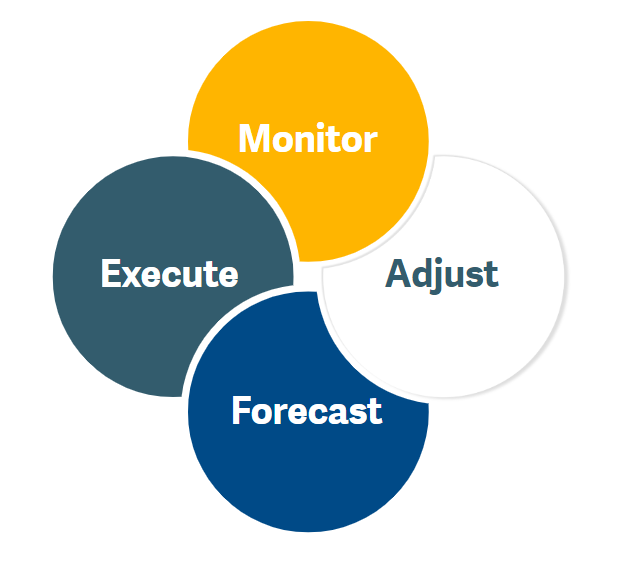

Dynamic planning

What is Dynamic Planning?

Dynamic planning is a continuous, forward-looking activity involving all stakeholders that supports the organization’s strategic objective.

Successful dynamic planning involves:

- Collecting and consolidating data quickly with accuracy

- Continuous stakeholder participation

- Frequent and more complete exploration of alternatives and contingencies to meet the strategic objective

3 Reasons to make planning more dynamic

1. Focus on business objectives not just budget

The goal of budgeting and planning is to link strategies to achieve the organization’s strategic objective. Dynamic planning brings agility to the process of translating strategy to targets and budgets. Finance and stakeholders can collaborate using actionable data to quickly measure progress towards predetermined targets and explore alternatives and contingences that increase the chances of meeting business objectives.

2. Maximize profit

The availability of fast and open information with continuous stakeholder participation allows you to leverage timely actionable insights to drive change throughout the organization as needed. This increases the value of key performance indicators (KPIs) to drive value creation. You can link KPI performance to on-demand resource management with dynamic planning.

3. Proactively manage resources

When dynamic planning is enabled, your organization can move beyond the standard annual budget setting and tracking. You can set short- and medium-term performance goals that support your strategic objective. When finance and stakeholders can access data in a timely manner, visibility and understanding of critical financial issues is maximized. You can quickly identify solutions that keep your organization on its path in achieving strategic success.

Components of dynamic planning

People

We need the stakeholders involved to continuously send and receive actionable insights and ask the appropriate questions to ensure the organization’s strategy is being supported. The finance team must continuously provide guidance and advice on how to ensure financial commitments (“the plan”) are delivered.

Process

A successful dynamic planning process must allow the stakeholders to provide input as required. The process must remove constraints such as geographical location. Continuous collaboration between finance and stakeholders is critical for successful dynamic planning.

Technology

Technology is an important foundation piece to successful dynamic planning. Technology can link people and process to drive successful dynamic planning. Finance and stakeholders must have access to the data to make critical decisions in a timely manner. Accuracy is critical.

Critical steps to dynamic planning

Monitor your budget in real-time

When it comes to the budget, the numbers that you planned for at the beginning of the year quickly become obsolete in a rapidly changing environment. Having up-to-date financial information is necessary to see the latest state of the business and respond accordingly. This understanding is critical to help identify expenses you should defer, key assets or people you need to protect, and to keep your business aligned in meeting its strategic objective.

Plan and adjust on-the-fly

Knowing where you are today is important. It helps you generate ideas on what changes might be needed. But knowing the impact of potential change is even more important. While we can’t predict the future, we can make educated guesses about what outcomes our decisions will make. Leverage scenario analysis to test the potential impact of assumptions. With a thorough understanding of the underlying numbers and potential impact, decisions can be made with a far greater certainty of success.

Implement frequent rolling forecasts

Once you commit to new changes based on scenario analysis, new financial forecasts are needed to ensure execution on those changes. Keep your forecast updated on a rolling schedule and adjust financial projections for the key areas within your business by leveraging stakeholder input. You may need the flexibility to re-forecast on a weekly basis to respond quickly to the rapidly changing environment.

Why choose Sage Intacct Budgeting and Planning?

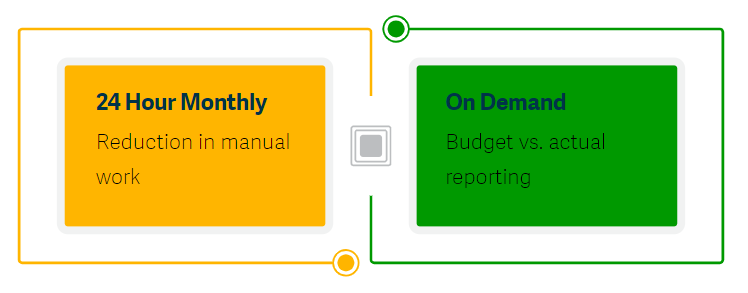

Rapid time to value

Leverage your Sage Intacct financial data, account structures, and dimensions along with best-practice templates to get up and running in days. Unlike other cloud solutions that take a long time to implement, harder to use, and are more expensive.

Secure your data

With Sage Intacct Budgeting and Planning, everyone works in a secure and controlled environment. Unlike spreadsheets that require significant resources and effort to prevent version control issues.

Control the process

Gain visibility and control across your budget process. The increased visibility and collaboration between finance and business owners simplifies critical planning tasks that lead to more effective budgeting and planning.

Knock

Knock gains on-demand insights with Sage Intacct Budgeting and Planning

“Scenario modeling in Sage Intacct Budgeting and Planning was very beneficial to decisions we needed to make early in the pandemic. As things changed through March, April, and May, we were able to update scenarios and recalculate the impact. We wouldn’t have been able to adapt and evolve as quickly if we hadn’t moved to Sage Intacct Budgeting and Planning”

Megan Dunne, Head of Finance

Takeaways

Sage Intacct Budgeting and Planning enables dynamic planning

To learn more about how Sage Intacct Budgeting and Planning can help you streamline your budgeting and planning process visit: https://www.sageintacct.com/products/cloud-based-budgeting-planning?referral=DeRosa

To learn more about how Sage Intacct can help you achieve your mission more efficiently, fill out the following information and DeRosa Mangold will be in touch.

DeRosa Mangold Consulting is a trusted team dedicated to partnering with you in a logical fashion to help you make the best decision for your company’s future growth. On average throughout multiple industries, startups to mid-sized organizations begin to see a return on investment in about 6 months. We will personally sit down with you and crunch the numbers, so you know when to expect your own ROI. We won’t tell anything but the truth so that you can make the best decision for your organization.

To learn more about DeRosa Mangold Consulting or Sage Intacct visit:

If you would like to take a quick look at the software, you can take part in one of the daily Coffee Break Demos we offer.