Sage Intacct surges past oracle netsuite to become solution of choice for fast-growing SaaS companies

With strong market momentum and new customers like ChurnZero, Sage Intacct has reached a milestone in our journey to be the financial management solution of choice for growing companies in the SaaS space.

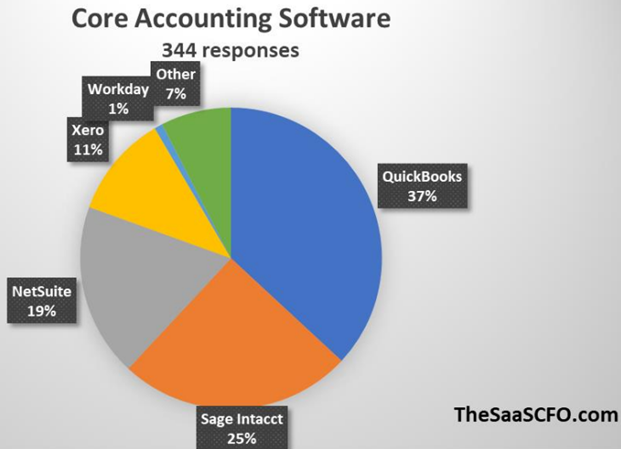

Sage Intacct today holds 25% market share for core accounting among SaaS companies—more than doubling from 12% in Q4 2020, according to a survey by The SaaS CFO.

With that growth, we’ve surged past Oracle NetSuite and its 19% market share (up slightly from 18% in Q4 2020), according to studies by The SaaS CFO, run by Ben Murray, a recognized expert in SaaS metrics and forecasting.

QuickBooks remains the dominant solution for SaaS companies, at 37% market share. But as Murray’s surveys reveal, QuickBooks’ niche is small companies with less than $10 million in revenue. If you’re a finance leader at growing SaaS firm, it’s not a question of if you’ll need to upgrade from QuickBooks—it’s when.

As the head of the SaaS/software vertical at Sage Intacct, it’s been extremely gratifying to see our cloud platform gain popularity reflected in The SaaS CFO studies thanks to customers like ChurnZero, a fast-growing provider of a customer success platform.

ChurnZero Prepares for Continued Growth with Sage Intacct

ChurnZero was outsourcing its accounting function, but wanted a proven, scalable in-house solution as it expands. Over the past three years, ChurnZero went from new entrant status to being recognized as a leader and one of the fastest-growing customer success platforms in the industry, having averaged over 100% revenue growth. In the last 12 months the company created subsidiaries in Australia and the Netherlands.

Aaron Levine, CFO at the 200-person company headquartered in Washington, D.C., says he’s observed the remarkable traction that Sage Intacct has gained among mid-market SaaS companies.

“A lot of people are talking about Sage Intacct,” as Levine told me in a video interview. “Sage Intacct seems to have the momentum. A lot of fellow CFOs I talk with like Sage Intacct and have had success with Sage Intacct. That’s really why I went with Sage Intacct.”

Levine first selected Sage Intacct in a previous CFO role at EveryAction, a provider of digital, fundraising, and organizing solutions for nonprofits and advocacy groups, where he served as CFO prior to ChurnZero. On Sage Intacct, EveryAction scaled annual revenue 6x, with strong organic growth and M&A.

‘Great Experiences’ at EveryAction

Before EveryAction, Levine had used NetSuite in two earlier positions. He knew what NetSuite was all about, and wanted to give Sage Intacct a try at EveryAction.

“I had great experiences with Sage Intacct at EveryAction, so I brought it over to ChurnZero,” Levine says. “We grew EveryAction pretty quickly and Sage Intacct handled all the M&A that we did.”

Levine’s extensive first-hand experience with both Sage Intacct and Oracle NetSuite has left him firmly in the Sage Intacct camp.

“My perception is that NetSuite’s kind of gotten stale under Oracle,” Levine says. “I think Sage Intacct is now certainly at parity with NetSuite, and is probably surpassing it in many, many areas.”

ChurnZero Takes Aim at Order to Cash

ChurnZero is working with CliftonLarsonAllen (CLA), a leading professional services firm named Sage Intacct’s Growth Partner of the Year for 2021, to go live in early 2023. Levine also partnered with CLA at EveryAction, and expects to replicate success at ChurnZero.

“The goal is to shorten the close, increase accuracy, cut out manual work, streamline processes, and standardize our entire order-to-cash process on Sage Intacct,” Levine says.

Levine says his team will make extensive use of the Sage Intacct Contracts module, integrating with Salesforce CRM to streamline order to cash, cut days sales outstanding, and accelerate cash flow.

“For ChurnZero, it’s really about nailing that order-to-cash process,” Levine says. “I like the functionality in the Contracts module a lot. I love the ability to integrate seamlessly with Salesforce. We just close an order, it pushes into Sage Intacct, and all the magic happens on the back end. So everything’s in one place. It’s a big win for us.”

In addition, Levine is looking forward to putting Sage Intacct’s global financial consolidation and currency conversion functionality to work for its global entities in Australia and the Netherlands. Built-in capabilities to recognize revenue with a few clicks will avoid any need for hours of manual spreadsheet work.

Leadership in Rev Rec and Invoicing

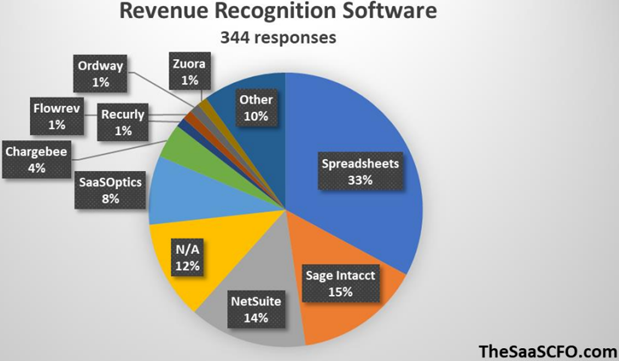

Speaking of revenue recognition, Sage Intacct has become the top rev rec solution (other than spreadsheets) in The SaaS CFO’s most recent survey. Our market share has grown to 15%, nearly doubling from 8% in Q4 2020. NetSuite remains at 14%, unchanged from Q4 2020.

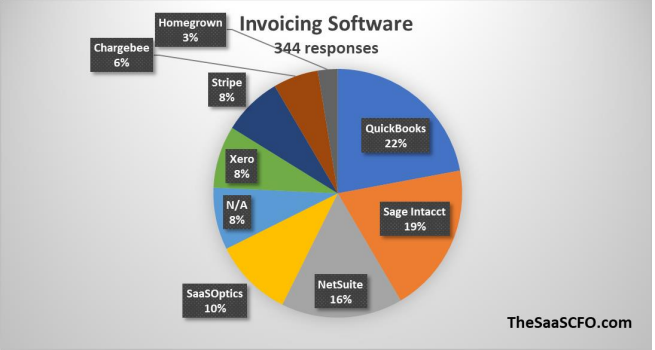

And for invoicing, Sage Intacct market share has grown from 12% in Q4 2020 to 19%, ahead of NetSuite at 16% (down from 18% in Q4 2020). QuickBooks is the most prevalent invoicing tool at 24%, with usage mostly by SaaS firms with less than $10 million in revenue.

What’s driving Sage Intacct’s growth in the SaaS/software vertical? You’ll find insights at www.sageintacct.com/easyclimb, where we’ve assembled resources to help SaaS finance leaders make informed decisions on financial management.

In videos and blog posts, you can learn about why customers such as Springbuk chose us over NetSuite, and why BFA Global and Aptitude Health switched off NetSuite to Sage Intacct.

You’ll see first-hand accounts from leaders at CoreCard, IZEA, and Marqeta on how they’ve strengthened SOX compliance, expanded internationally, and gone public on our platform. You’ll find out how they’re using the solution, and the benefits they’re gaining in areas such as efficiency, reporting, forecasting, visibility, and compliance.